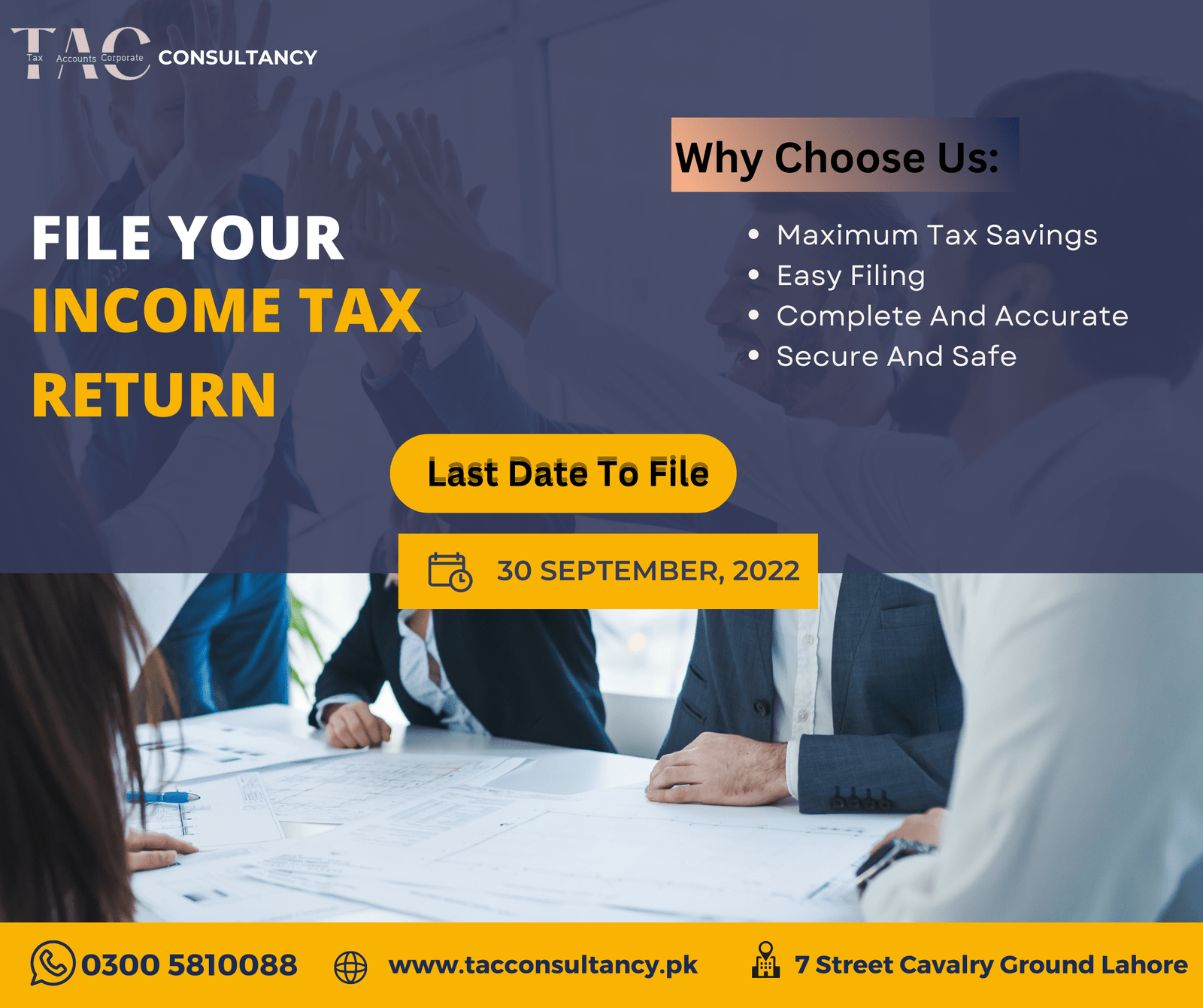

Tac Consultancy

TAX ACCOUNT CORPRATE

Tac Consultancy

SALES TAX RETURNS – PAKISTAN

Sales tax comes from the payer’s document of declaration through that taxpayer. Not solely furnishes the main points of transactions throughout a tax amount but conjointly deposits his nuisance tax liability.

Every person registered under the nuisance tax Act,1990. Or the Federal Excise Act, 2005, needs to file a nuisance tax come. On the return form, the payer declares a certain tax amount. As well as various input taxes and output taxes, all at the specified Sale Tax rate if the amount of input tax is more than the amount of output tax, the statement additionally includes the amount of claimed refunds or excess input tax.

A registered person shall file one come for all the attainable sectors that the registered person is working in. day of the month for the only come for the sectors would be the day of the month applicable to his significant activity in terms of nuisance tax or federal excise duty due.

Where a nuisance tax come not filed among the amount of six months once the day of the month. An equivalent shall be filed solely once approval of the Commissioner administrative unit has the proper jurisdiction.